Tax Advantaged Accounts

FSA and HSA

The Flexible Spending Account (FSA) and the Health Savings Account (HSA), administered by WEX, allow you to set aside pre-tax dollars to pay for your eligible out-of-pocket benefit expenses. The money you contribute is taken from your pay before income and social security taxes are taken out, lowering your taxable income.

Healthcare FSA

(HCFSA)

A HCFSA is used to help pay for health care expenses that are typically not paid for by your health plan.

You may contribute up to $3,050 pre-tax annually to the HCFSA.

While a HCFSA can help you pay for many health care services, IRS regulations do not allow you to use it to pay for health insurance premiums and cosmetic treatments. Services must be intended to treat or prevent a specific

medical condition.

Refer to plan documents for a list of ineligible expenses

Dependent Care FSA

(DCFSA)

A DCFSA is a pre-tax benefit account used to pay for eligible dependent care services, such as preschool, summer day camp, before or after school programs, and child or adult daycare.

Your household may contribute up to $5,000 per plan year.

Note that eligible expenses are those costs related to dependent care while you are at work. For school age children, those expenses may include the cost of care before and after school.

Unlike the HCFSA, with the DCFSA, you may only be reimbursed for up to the amount you have accrued in you DCFSA account.

Limited Purpose FSA

(LPFSA)

The LPFSA is available exclusively to those enrolled in the High Deductible Health Plan/Health Savings Account (HDHP/HSA).

With the LPFSA, you're limited to spending the account on vision and dental plan expenses (such as copays, coinsurance, and amounts greater than the plan limits).

The LPFSA allows a pre-tax deposit of up to $3,050 each plan year.

Note that you must exhaust your account each year or risk forfeiting your remaining balance.

Health Savings Account (HSA)

If you are enrolled on the High Deductible Health Plan, you can use your pre-tax HSA funds for qualified medical expenses. The HSA is owned by you and never expires.

2023-2024 PY Maximum contribution amounts:

- Individual account: $4,150

- Family account: $8,300

- Catch-up for 55 and older: $1,000

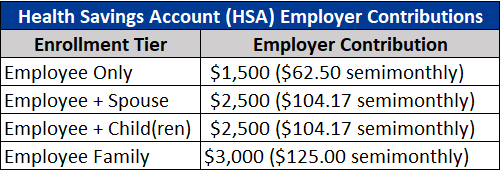

Employer Contributions:

- Employee only: $1,500/year

- Employee +1: $2,500/year

- Family: $3,000/year

National University Contributions to the HSA

Employer contributions to the HSA are spread out across 24 paychecks (twice a month).

2023 Documents & Resources

Health Savings Account